Major Feature Enhancements

HOT-13475 - Read Only configuration- Changed Final Lock status to Loan Finalized.

As a part of the story, we have updated the configuration setting for Read Only from Loan Funded to Loan Finalized. If this setting is ON then Company/Branch Admin loans which are in the “Loan Finalized” stage will be in editable mode.

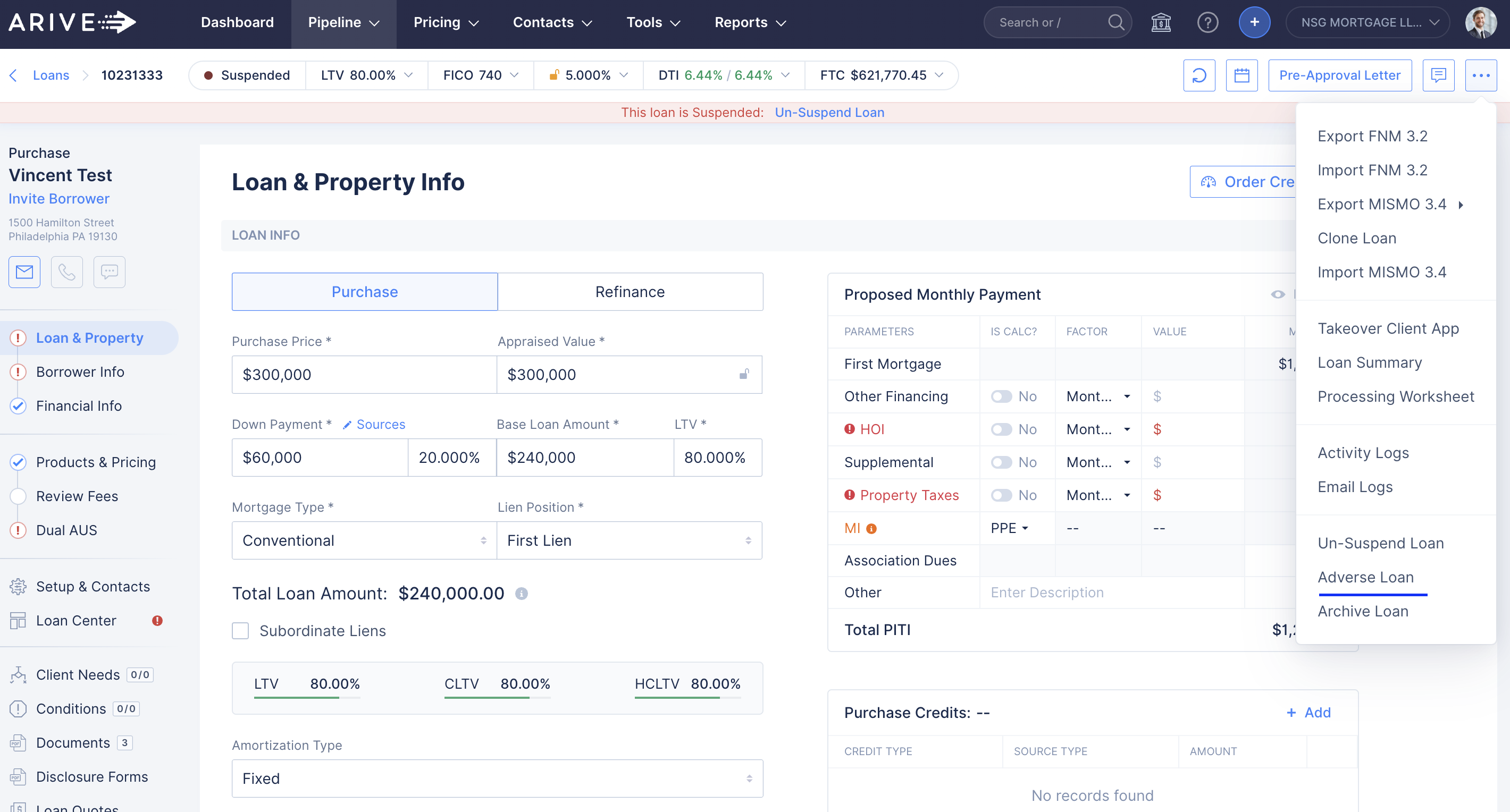

HOT-13283 - Allow Suspended Loan to be updated with Adverse Stage.

Users are now allowed to Adverse the Suspended Loans.

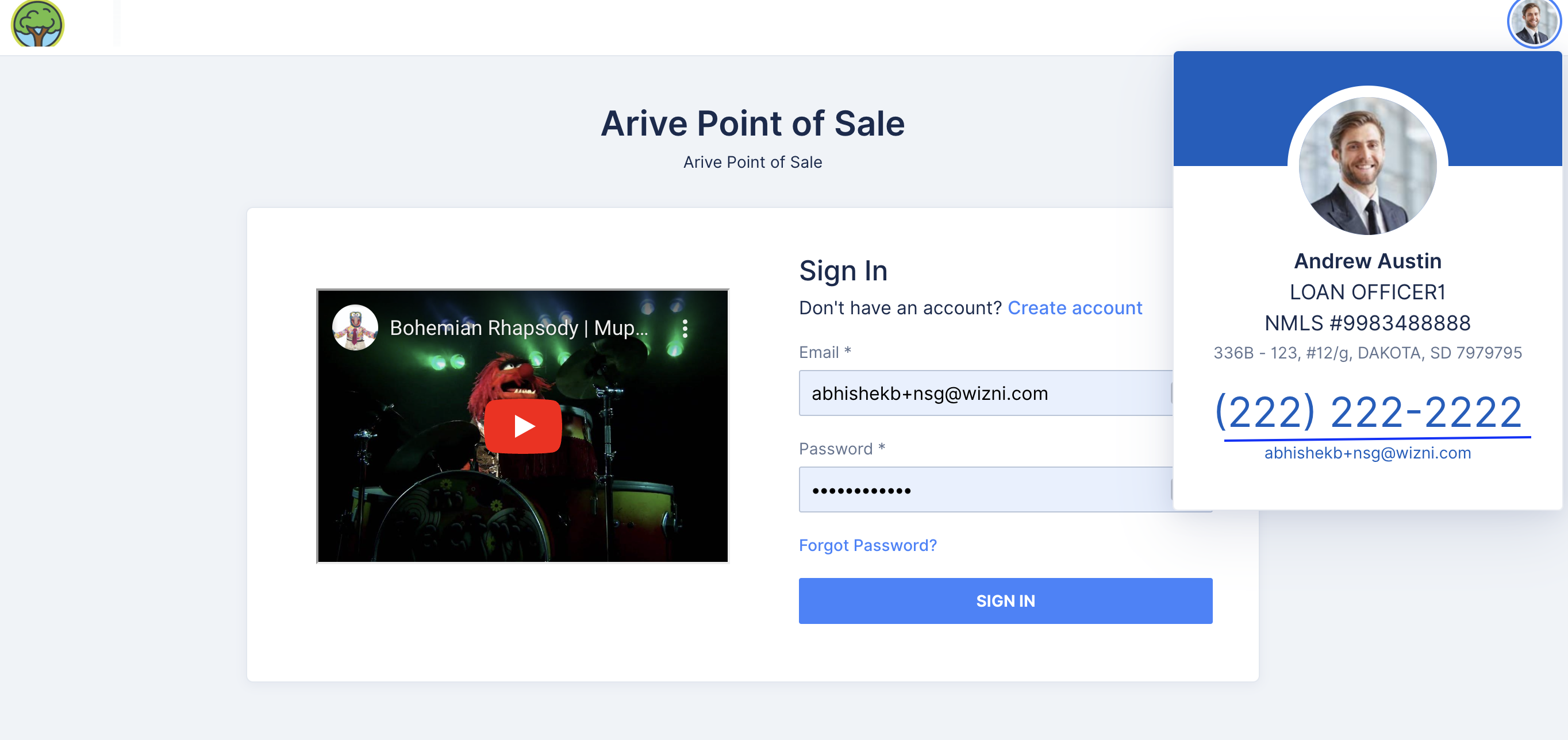

HOT-13167 - Point of Sales - Loan Officer mobile number display.

As an enhancement, we have updated Loan Officer information in Point of Sales with the following:

- Show Loan Officer's Mobile Number.

- If the Mobile Number is not available then show Work Phone.

HOT-13061 - Make title Info available by adding new tags.

We have added two new tags for email templates and Pre Approval Letters:

- Property Title Holding Manner. }}=> {{property.titleHoldingManner}}

- Property Title Holder Name(s) => {{property.titleHolderName}}

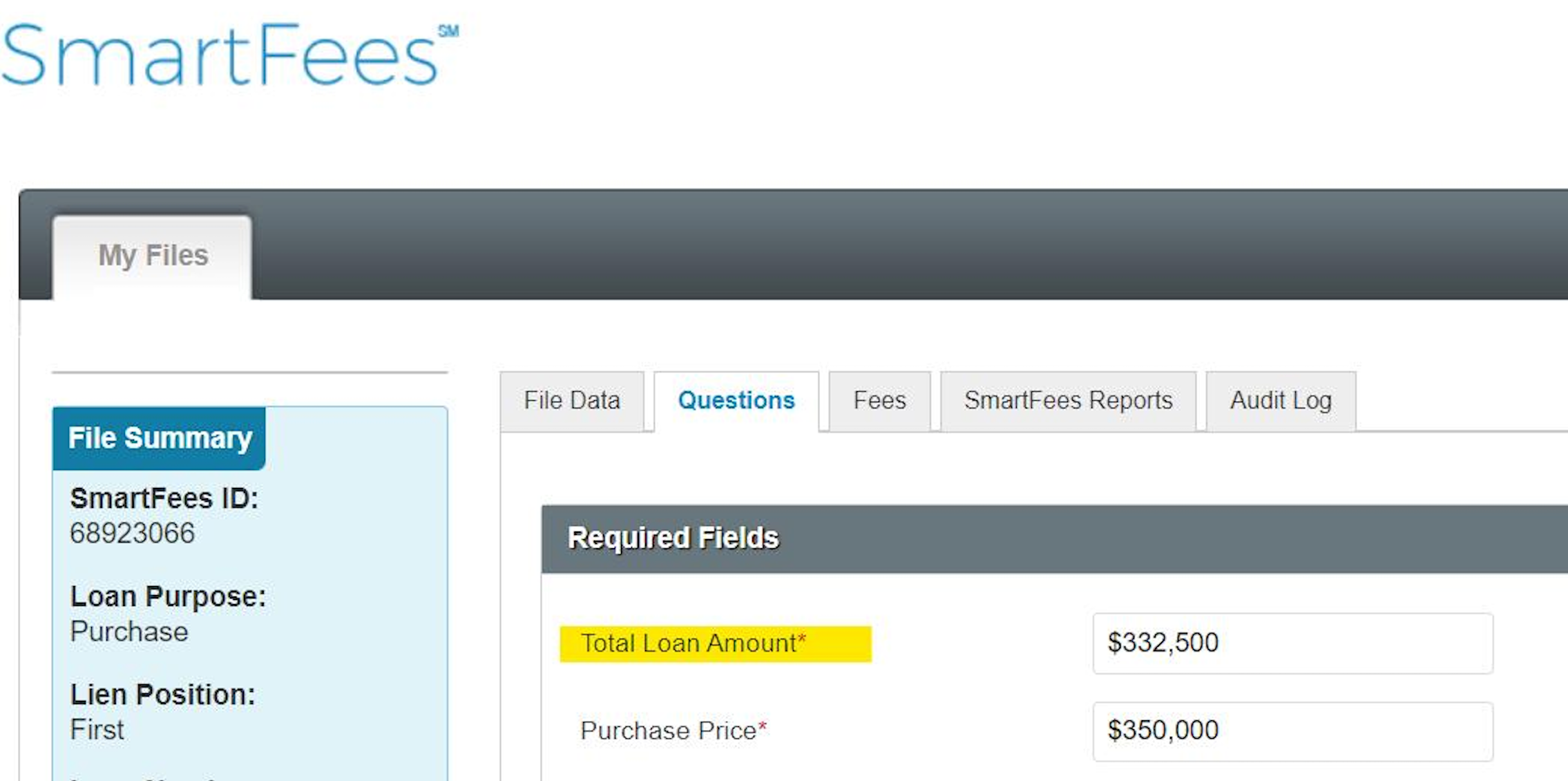

HOT-12991 - Send the Total Loan Amount for FHA/VA loans to a smart fee.

As an enhancement, we will be sending the Total Loan Amount to the smartFee service asTotal Loan Amount = Loan Amount + Funding Fee

HOT-12785 - Handle Non Borrowers for Residual Income calculations.

For VA Residual Income calculation, now we will only consider Borrowers with the role of Borrower, all other types of roles and their dependents will be ignored.

HOT-12468 - Fetch result must have at least one REA of all types if present via ZAP.

As an enhancement request, we are now fetching at least one REA of all types in the Get Loan Details API.

HOT-12321 - Added more fields for the Get Loan Details API in ZAPIER.

All below fields are added in Get Loan Details API only.

| LOS UI field name | Name in API Response |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOT-12059 - Added additional data field to auto-populate on disclosures.

The following new fields are added to the custom form 'Dynamic Fields' section:

- Borrower Mailing Address

- Primary Borrower Mailing Address

- Co-Borrower Mailing Address

- Mortgagee Clause - Closing Protection Letter

- Mortgagee Clause - Homeowner’s Insurance

HOT-13266 - Disclosure form: Update 4506-C IVES Request for Transcript of Tax Return.

Added updated 4506-C IVES Request for Transcript of Tax Return with the latest version.

HOT-13148 - Disclosure form: Update FHA Loan Underwriting and Transmittal Summary form. Added updated FHLA Loan Underwriting and Transmittal Summary with the latest version.

HOT-13148 - Disclosure form: Update 1003 form with Supplemental Consumer Information. Added Supplemental Consumer Information in 1003 form. This information will be taken from the Borrower section.

Additional Fixes/Enhancements

HOT-13599 - POS: Additional Questions: UI fixes.

POS: Additional Questions: Checkbox Type Question - checkbox label text UI is displayed as wrap text if we have long text for the checkbox option.

HOT-13474 - Red Exclamation mark on the borrower info tab.

For Refinance loans when the TBD indicator is ON in Subject Property then if a borrower enables toggle for “Same as Subject Property Address” in current address then the Red Exclamation mark on the borrower info tab will not appear.

HOT-13224 - POS window showing the default pic for a sec then uploads the new pic.

Fixed: POS window now shows the correct customized theme without any delay.

HOT-13124 - The loan Amount shown in Call Report doesn't match the Loan Amount in the loan file in case of a Closed Loan import.

- Now, in the case of closed loan import, the loan amount in the call report is the same as that of the loan amount in the loan file.

- On creating a closed loan, the loan is reflected in the quarter as per the dates mentioned.

- When we create a closed loan in Q4 of 2022 then the loan is reflected in Q4 of 2022, If we change the loan amount of the closed loan in the current quarter then the changes will not be reflected in the “AC065” field of the current quarter, the loan amount of closed loan will get changed in their old call report Q4 of 2022.

- If the loan amount in the loan file is zero then in the call report loan amount will show $1000.

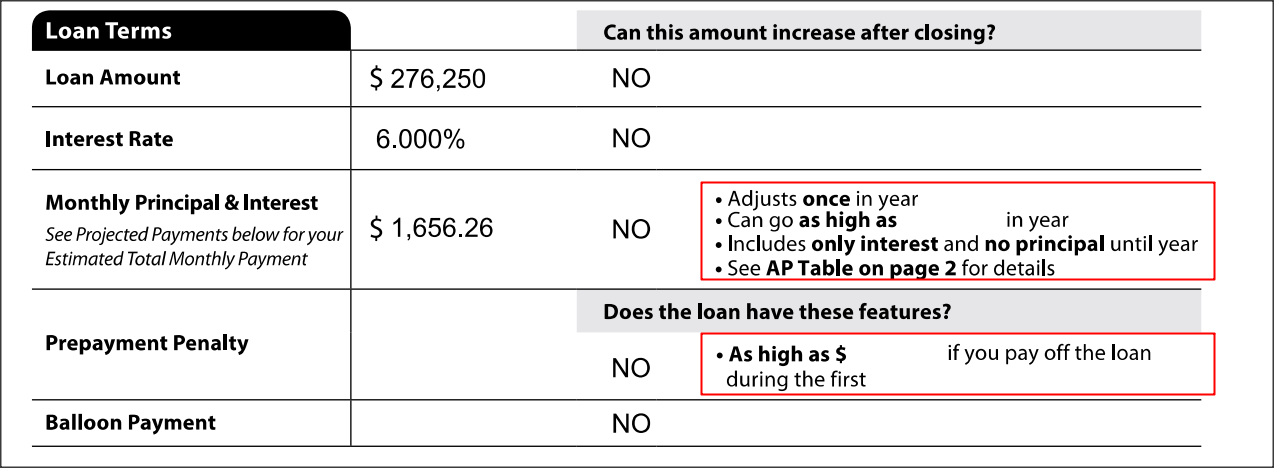

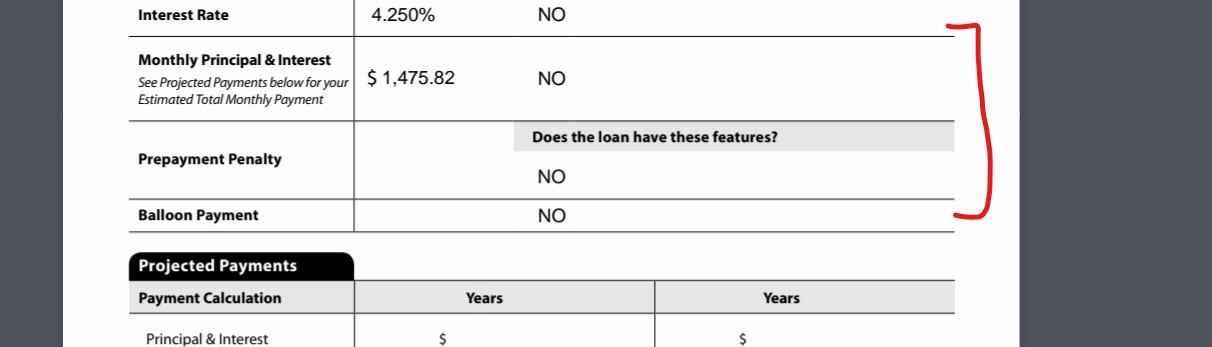

HOT-13057 - LE in Arive Forms List showing prepaid penalty and rate adjustment info when answered "NO"

In the Loan Estimate Arive form if NO is appearing under “Monthly Principle & Interest and also Prepayment Penalty” then no additional info will be displayed. Before: After:

After:

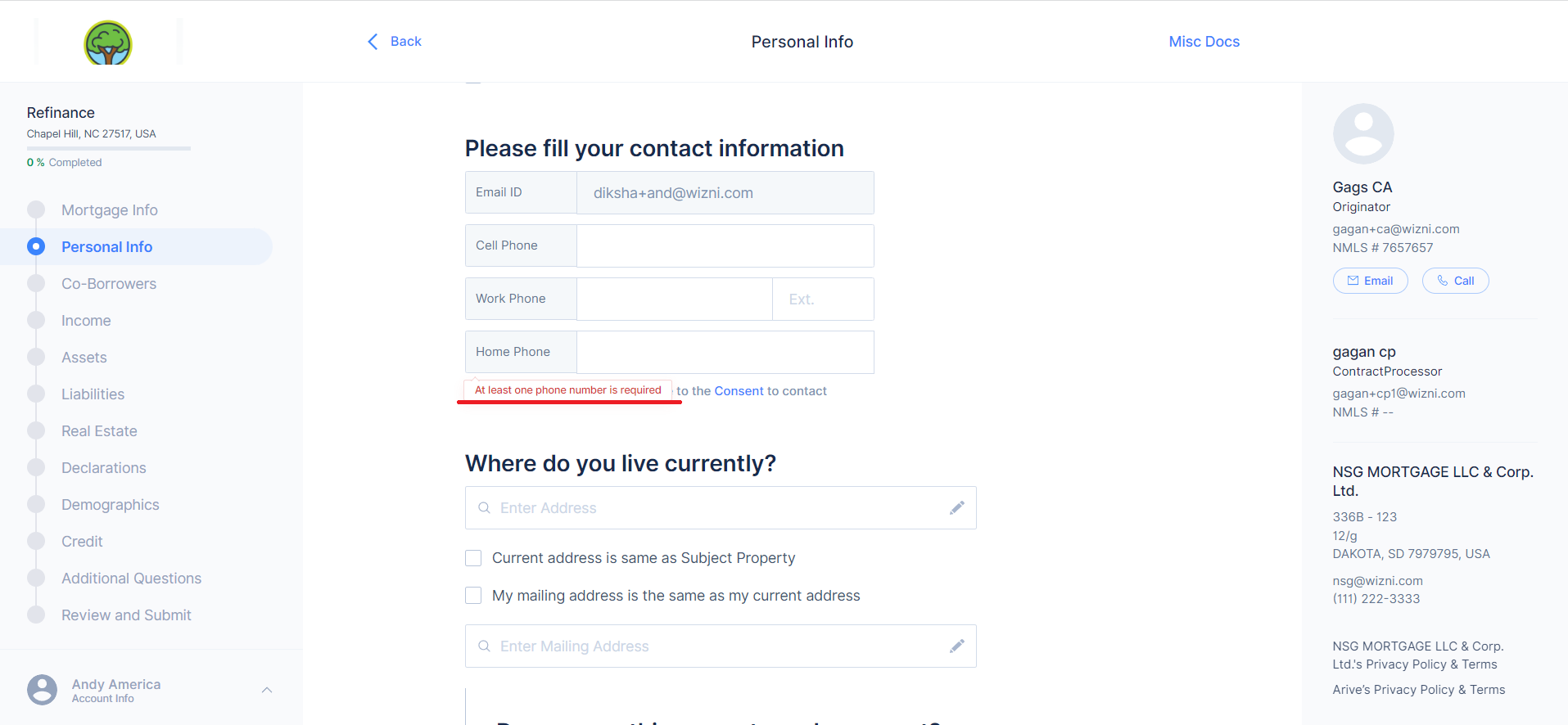

HOT-13025 - Typo Fix: The error message when no phone number is added.

- Now in 1003 form in POS, if you skip a phone number then the borrower will prompt with a message to put in "At least one phone number is required".

HOT-12478 - Quote > Prepaid Interest is recalculated on rate change from Quotes.

Fixed: In case generated quotes have a closing date and prepaid interest days are already calculated. Now user changes the rate from the quotes view, the system is recalculating prepaid interest days taking the current date as the new closing cost date which is wrong and in this particular case expected should be - Prepaid interest days should not change with changing rate where we already have closing cost date.

HOT-12463 - Fixed: Client needs condition (Residence Type) for document signature need

Fixed: Due to the signature document Need type present in the Client Need rule, the Residence Type condition permanent Resident Alien or Non-Permanent Alien condition is not triggered when the borrower is selecting the same.

Looking forward to hearing your feedback.

Thanks,

Team ARIVE